IAG Cargo, the cargo division of International Airlines Group (IAG), is announcing the start… Read more »

IAG Cargo, the cargo division of International Airlines Group (IAG), is announcing the start… Read more »

IAG Cargo, the cargo division of International Airlines Group (BA and Iberia), today announces… Read more »

IAG Cargo, the cargo division of International Airlines Group (IAG) announces it will restart… Read more »

WiseTech Global has announced that IAG Cargo, the cargo division of International Airlines Group… Read more »

IAG Cargo, the cargo division of International Airlines Group (IAG), has launched its 2023… Read more »

IAG Cargo, the cargo division of International Airlines Group (IAG), has begun to trial… Read more »

IAG Cargo, the cargo division of IAG (International Airlines Group) has reported record financial… Read more »

IAG Cargo, the cargo division of International Airlines Group (IAG), has increased services to… Read more »

IAG Cargo, the cargo division of International Airlines Group (IAG), will be creating more… Read more »

IAG Cargo has launched a new direct service from Madrid, Spain to Male, capital… Read more »

This month (April 2021), IAG Cargo, the cargo division of International Airlines Group (IAG),… Read more »

Over a million Covid-19 vaccines around the world have been transported by Global Network… Read more »

IAG Cargo has today announced its 2019 full year results, reporting commercial revenues of… Read more »

IAG Cargo has today announced that from summer 2018 it will be launching a… Read more »

IAG Cargo has announced the introduction of a new direct service to Nashville, Tennessee.… Read more »

IAG Cargo has launched a new freighter service between Madrid and Basel. The new… Read more »

IAG Cargo has seen a boom in demand on key routes from Europe into… Read more »

As the transportation industry evolves, software solutions are becoming increasingly critical in managing complex… Read more »

With the Linde L10 – L16 B pallet stacker, Linde Material Handling (MH) is… Read more »

Today, at its Beyond conference, Samsara Inc. (NYSE: IOT), announced new products and solutions… Read more »

SICK UK unveiled its trailblazing SICK Augmented Reality Assistant (SARA) at Smart Factory Expo… Read more »

As the demand for new trucks tends to outpace their supply in times of… Read more »

Jungheinrich, RAVAS EUROPE, SAFELOG with Mercedes, SSI Schäfer and STILL have been announced as… Read more »

Joe Morris (pictured) played a pivotal role in the success of TJ Morris, trading… Read more »

AR Racking, a global leader in industrial storage systems, has successfully concluded its collaboration… Read more »

Repeat custom now accounts for almost two-thirds of the Beumer Group’s business. That’s why… Read more »

The KAUP Cask Handler 0.3T415W provides new possibilities for internal transport logistics. This forklift… Read more »

HUBTEX is expanding its MaxX series with a new model – the MaxX 60… Read more »

IAG Cargo, the cargo division of International Airlines Group (IAG), has recently invested €1.5… Read more »

First Exhibitors Announced for IAA TRANSPORTATION 2024: Leading Companies to Showcase Solutions Towards Climate… Read more »

Clark is presenting the new S-Series Electric to the public for the first time… Read more »

St. Modwen Logistics, one of the UK’s leading logistics developers and managers, has started… Read more »

Suzi Perry hosted a crowd of over 550 at the British International Freight Association’s… Read more »

American Airlines Cargo announces today that it reduced long-term plastic waste by more than… Read more »

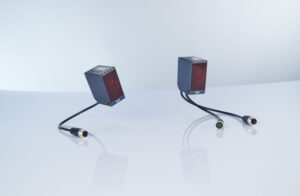

SICK has launched an industry-first safety light curtain system for Smart Box Detection, designed… Read more »

With the launch of its next-generation DT80 distance sensor, SICK claims to have revised… Read more »

Senior Executives at Samsara are forecasting trends in physical operations for next year and… Read more »

In an attempt to overhaul the current EU framework governing live animal transport, the… Read more »

Intralogistics specialist Linde Material Handling and the Aschaffenburg University of Applied Sciences (UAS) presented… Read more »

Konecranes delivered 7 forklifts and 2 gantry cranes to Eldorado Brasil’s new cellulose terminal… Read more »

To enable businesses to future-proof their increasingly diverse labelling needs, TSC Printronix Auto ID… Read more »

SICK has pioneered the addition of IO-Link to two of its most compact and… Read more »

Stock-taking in a warehouse is a time-consuming, manual process. Until now. David Priestman visited… Read more »

Noone Transport, based in Co. Meath, Ireland, is undergoing a period of significant investment… Read more »

Jungheinrich is connecting its fleet by equipping all its new trucks with telemetry units… Read more »

Hyster has introduced a new Reach Truck that works inside and outside providing even… Read more »

IAG Cargo, the cargo division of International Airlines Group (IAG), is today announcing Cincinnati,… Read more »