Supply chain risk jumps to nine month high as supply chains are rocked by the collapse in commodity prices

12th February 2015

- The CIPS Risk Index reversed its improving trend, moving to 78.2 in Q4 2014 from 77.9 in Q3

- Lower fuel prices have made it cheaper for businesses to internationalise and therefore lengthen their supply chains

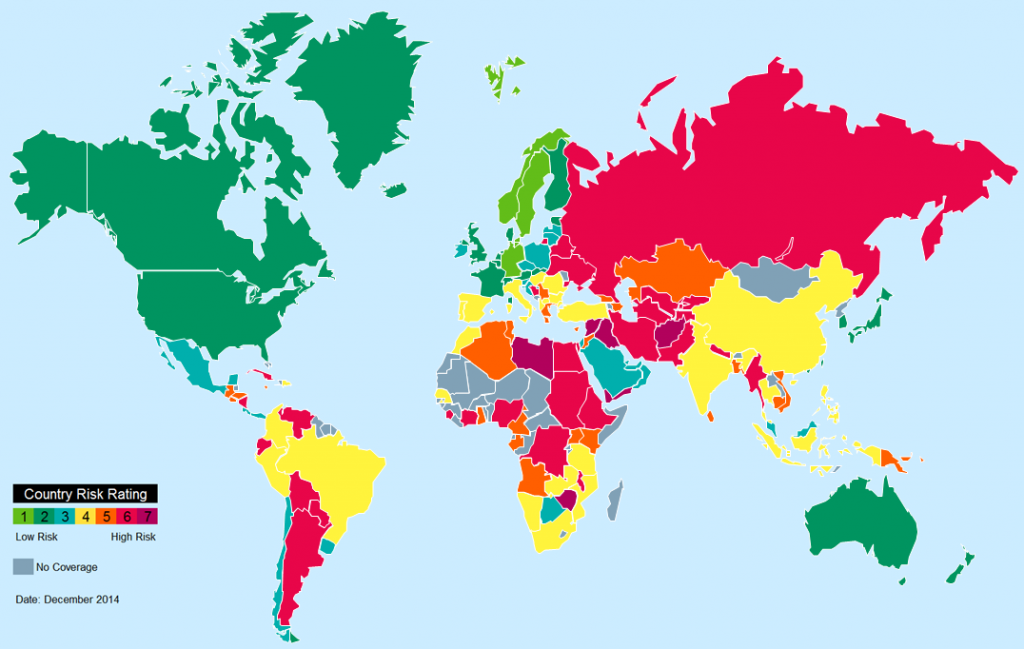

- Suppliers across Sub-Saharan Africa, Asia, Eastern Europe and Latin America pose an increasing risk to the businesses they work with

The world opened up for procurement managers in Q4 2014 with an abundance of cheap oil and gas making suppliers in far flung corners of the world instantly more competitive. Combined with low commodity prices in everything from gold in Ghana to soy beans in Brazil, manufacturers at the top of the global supply chain have grown the complexity and length of their supply chains whilst reducing their input costs.

However, declining commodity prices have also had a considerable unforeseen impact on suppliers at the very base of world supply chains. Whilst commodity producers themselves are the most obvious sufferers from the slump in prices, worsening trade deficits have slashed the value of currencies and cut the spending power of national governments which have had a negative effect on suppliers in certain parts of the world.

Suppliers in Asia, Latin America, Eastern Europe and Sub-Saharan Africa are particularly feeling the pinch, with reduced fuel costs opening up competition for contracts beyond national borders. This means there is a heavy downward pressure on the prices all suppliers can charge, a pressure which will impact the quality of their products, their delivery speed and the working environments for their employees.

Australia, in particular, has seen commodity prices put pressure on the mining industry, where a combination of low levels of investment and falling levels of unemployment have forced down competitiveness. The importance of Australian raw materials across Asia Pacific is the principle driver for the regions increased risk score in Q4, up to 25.65 from 25.55 in Q3.

In Latin America, Brazilian, Chilean and Argentinian suppliers are all suffering from lower soy bean and copper prices. Taken together with austerity measures necessitated by the economic recession, Brazil is experiencing violent political protests which could see supply chains disrupted further.

In Sub-Saharan Africa, meanwhile, the drop in commodity prices has had a serious impact on national budgets, with Nigeria, for instance, earning 90% of its government revenue from oil. With budget deficits rising, infrastructure improvements, which have proved a vital source for growth in recent years, may be cut and with them access to foreign markets. Finally Eastern Europe, already one of the most risky regions for supply chains to enter, has been further hit by a combination of deteriorating oil prices and the knock-on effects of further EU sanctions against Russia.

Only Western Europe has seen a marginal reduction of supply chain risk (from 24.20 to 24.16), with advanced manufacturers in Germany especially, able to pass on the benefits of lower input costs to consumers with the price index for consumer durables falling by 0.4% year on year in December. Even here, however, the outlook is bleak with the resulting deflation threatening to leave the region in a spiral of price reductions.

John Glen, CIPS Economist and Senior Economics Lecturer at The Cranfield School of Management said:

Reductions in commodity prices are not universally beneficial. Those at the top of the supply chain are immediate benefactors but those further down the chain have to contend with increased pressures from a variety of sources.

The lower prices manufacturers are paying for commodities will put pressure on their suppliers, who must cut their costs to compensate. In the long term this means corner cutting, declining working conditions and delayed deliveries from suppliers.

To mitigate the challenges these pressures pose, strict adherence to best practice is essential for procurement managers with supply chains reaching into growing risk areas, such as Australia and Brazil.

Andrew Williamson, Global Leader and Leading Economist, Dun & Bradstreet:

As we cautioned in the last edition, the CIPS Risk Index score reversed its improving trend in Q4, deteriorating for the first time in five quarters. The sluggish and uneven pace of the global recovery has kept the risk score uncomfortably close to the historical high recorded in Q3 2013, and in Q4 2014 this unfavourable background was exacerbated by the impact of the low commodity prices on key emerging markets and by increasing geopolitical risk.

Apart from the US and the UK, growth in the developed world remains sluggish. Nor are emerging markets able to drive global growth, as key economies (Brazil, China, Russia) are also experiencing a slowdown. Geo-political risk remains high, with the conflict in the Ukraine still smouldering and large parts of the Arab world in a state of open conflict or unstable peace. Meanwhile, the most immediate and visible effects of the oil price collapse have been negative, with a deterioration of energy-exporting countries external and fiscal positions. However, we expect to see more positive consequences of the low cost of energy in 2015, as the favourable impact on companies costs and consumers disposable incomes is reflected in higher economic growth in most countries.