NAI apollo group publishes report on the logistics property and warehouse market in the Rhine-Main area for the first half of 2015

23rd July 2015

- Take-up doubles in second quarter after weak start to the year

- Large pre-lettings in new project developments dominate the market

- South remains the most important sub-market; Wiesbaden-Mainz records largest increase in take-up

- Industrial companies are biggest consumers in sub-5,000 category

- Outlook for 2015: Take-up in line with 2011-2013 levels, but no repeat of annual record result from 2014

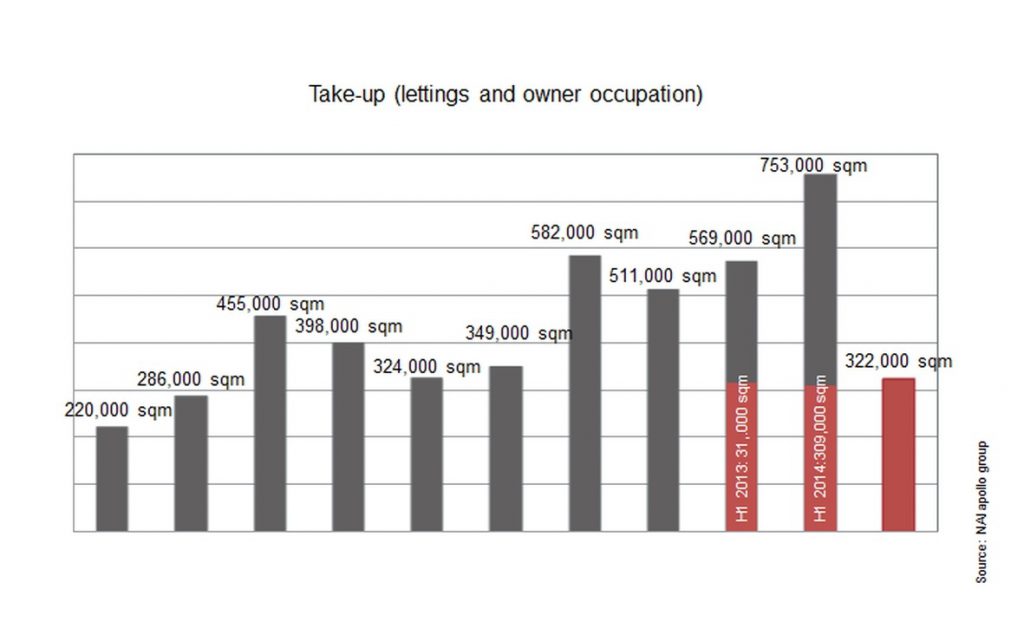

According to an analysis conducted by the owner-managed real estate services group NAI apollo, the market for logistics property and warehouses in Frankfurt/Rhine-Main* recorded significant growth in the period from April to June 2015 after a weak start to the year. Quarterly take-up by owner-occupiers and tenants reached 216,430 sqm, clearly exceeding both the previous quarter by 104.5% (Q1 2015: 105,830 sqm) and the previous years Q2 period by 82.6% (Q2 2014: 118,520 sqm). In the first half of 2015, the total volume amounted to 322,250 sqm and was therefore 4.4% above the previous years level (H1 2014: 308,820 sqm).

Nonetheless, the record result of more than 753,000 sqm for 2014 is not expected to be achieved again in 2015. Instead, the market will continue to develop in line with the period from 2011-2013 and will presumably again exceed the 500,000-sqm mark by the end of December, said Michael Weyrauch, partner at the NAI apollo group and responsible for the companys logistics division.

A major factor for the market revival was the increase in project development pre-lettings and large owner-occupier projects. Compared to previous years, these were still under-represented in the first three months with a take-up share of 30.2%. However, at the end of the first six months a volume of 137,710 sqm related to leases in new developments and 19,550 sqm to owner-occupier projects, explained Dr. Konrad Kanzler, Head of Market Research at the NAI apollo group. This amounts to a joint market share of 157,260 sqm or 48.8%, thereby almost repeating last years high level (H1 2014: 54.7 % or 169,000 sqm).

The seven contracts in the large-unit segment (>10,000 sqm) accounted for 162,000 sqm or approx. 50.3% of the half-year volume and included four pre-lettings in new project developments with a combined 112,500 sqm of warehouse and logistics space. This includes the two largest deals of the year to date: the leasing of around 40,000 sqm of warehouse space by logistics service provider Rhenus in the VGP-Park in Rodgau as well as the conclusion of a contract by SLL System Lager Logistik (a Rigterink group company) for approx. 39,000 sqm of warehouse space in the West V industrial park in Florsheim, which is being built by IDI Gazeley. The largest lease contract in an existing property was concluded by a commercial company and comprised 20,000 sqm in Gro?-Gerau.

The South-East and South-West sub-markets, which are traditionally popular across all size segments, remained a strong focus and accounted for 95,500 sqm and 74,750 sqm respectively. The southern region of the market area accounted for 52.8% of space take-up overall, although this represents a decline of 5.5 percentage points compared to the first half of 2014. In an annual comparison the victor is the Wiesbaden-Mainz sub-market, where four contracts for units larger than 5,000 sqm have already taken place this year. This in turn has raised the market share of this sub-market by 13.8 percentage points to 14.5% or 46,650 sqm.

In terms of the different industries, the transport, warehouse and logistics sector raised its market share slightly from the previous year (H1 2014: 52.0 %) to 54.7% (176,170 sqm). Trade retained its second place with a share of 23.3% (75,010 sqm), but lost market share compared to the first half of 2014 (H1 2014: 35.9%). In contrast, third-placed industrial companies considerably boosted their market share to 16.7% with a volume of 53,690 sqm, compared to 7.1% in the first half of 2014, said Kanzler. These companies were the most important consumers of space in the segment below 5,000 sqm, with a 37.8% share of take-up or 38,820 sqm.

In the coming months, NAI apollo group expects market activity to remain buoyant. According to Weyrauch: The owner-occupier project of packaging manufacturer DS Smith, on which building work is about to begin at the former air base in Erlensee, will provide 40,000 sqm of warehouse and logistics space alone. Speculative developments – those that are either under construction such as in Neu-Isenburg or in the planning stage such as in Weiterstadt – will also meet corresponding demands for new and modern spaces.

*NAI apollo group defines the Frankfurt/Rhine-Main market area for logistics and warehouses as the relevant available logistics and warehouse space between the cities of Butzbach in the north and Worms in the south, as well as between Bingen in the west and Aschaffenburg in the east. The City of Frankfurt am Main forms the central point of the sub-market described.