Economic Headwinds Starting to Bite in Europe, Says TMM

3rd May 2019

The Transport Market Monitor (TMM) has revealed evidence of a decline in economic growth in Europe.

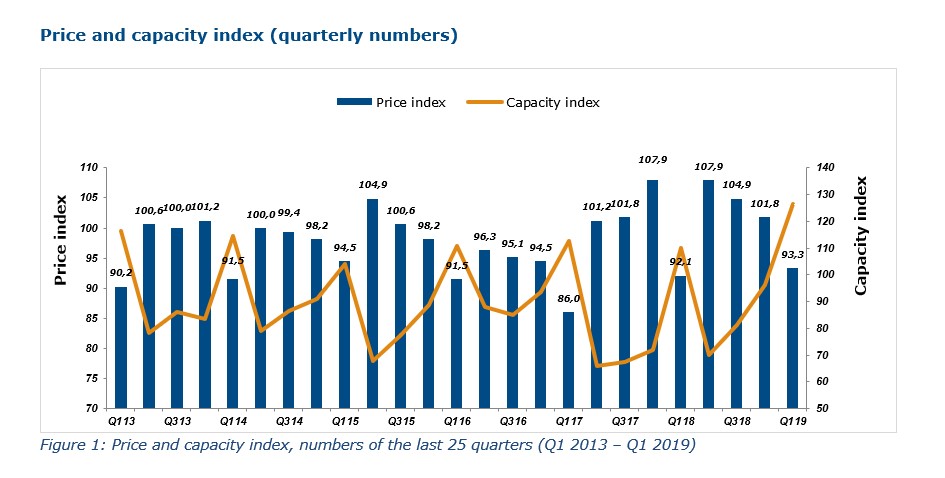

In Q1 2019, available road transport capacity increased by almost a third compared to Q4 2018. This indicates that at the beginning of this year significantly fewer goods were hauled on roads than in previous months. Compared to Q1 2018, from January to March an additional 14.9% of transport capacity was available. The strong increase indicates that the European and German economies are beginning to experience slower growth. In addition, in Q1 2019 transport prices were 8.4% lower than in Q4 2018, partly due to a significant decline in diesel prices.

This data is obtained from the 39th edition of the Transport Market Monitor (TMM) by Transporeon and TIM CONSULT. The key findings are:

In Q1 2019, the capacity index rose by 31.4% over the previous quarter to 126.5 index points (Q4 2018: index 96.3)

The transport price index in Q1 2019 decreased to 93.3 index points, which equals a drop of 8.4% compared to Q4 2018 (index 101.8). The price index was thus 1.3% higher than in Q1 2018 (index 92.1)

The diesel price index in Q1 2019 was 9.3% lower than in Q4 2018

With transport capacity continuously increasing in the second half of 2018, in Q1 2019 an additional 31.4 % of free cargo-space became available for shippers. “The strong increase in available transport capacity that we monitored in the recent months is initial evidence of a slowdown in economic growth. The German government’s Annual Economic Report 2019 published at the end of January is supporting this view, which assumes an increase of the price-adjusted GDP by only one percent”, states Oliver Kahrs, Managing Director TIM CONSULT.

As increasing transport capacity comes available, the price difference between the cheapest and the most expensive offer per transport order on the spot market is also rising. Transporeon’s Jan Rzehak said: “For seasonal reasons, the available transport capacity usually is greater in the first months of a year. Therefore, the price difference in the first quarter tends to be higher. In 2019, however, with 25% it was particularly large. Shippers are therefore likely to have benefited from more favourable prices placing their transport offers on the spot market. To observe such huge differences between the highest and lowest offer per transport order we have to go back to Q4 2009. In view of the current economic development, the price difference is likely to remain above average in upcoming months. Therefore, transport assignment on the spot market will remain highly attractive.”

The TMM is derived from spot market data on the Transporeon platform based on the ‘best carrier’ transport assignment solution. It is published on a quarterly basis.