Collaboration and Digital Fitness Essential To Future T&L Industry, Says PwC

28th September 2016

The global transportation & logistics (T&L) industry is facing dramatic realignment in an era of unprecedented change as new digital technologies, changing customer expectation and collaborative operating models reshape the marketplace.

Thats according to a new PwC report, Shifting Patterns the future of the logistics industry, which says that the prize for modernising even segments of the industry can be huge. The report points to digital, data analytics and platform technology as facilitating new entrants, new business models and new sharing opportunities.

PwC research suggests that, while 90% of T&L companies see data and analytics as the key drivers in redefining the sector over the next five years, 50% acknowledge that the absence of a digital culture in their own organisation is the single biggest challenges they face.

Yet, despite its seeming shortcomings, the industry is proving a magnet for investors. Since 2011, around $160m – $150m of which is private equity (PE) – has been invested in digital logistics alone.

Coolin Desai, PwC UK partner and head of transport, says that this alone suggests that investors see scope for new entrants disrupting established players and for strong returns from a $4.6 trillion market:

Technology is changing the face of the industry and, for T&L companies wherever they might be, digital fitness and clear market focus will be essential prerequisites for success.

The real pressure points are emerging globally and particularly in the US markets, but change is already beginning to impact the UK T&L market. It is important that companies remain alert to how new technologies, from data analytics to automation and platform solutions, are transforming the wider markets. In this market, early adopters may win early advantages.

Companies that make themselves digitally fit and anticipate opportunities will be most attractive to investors to markets and to customers.

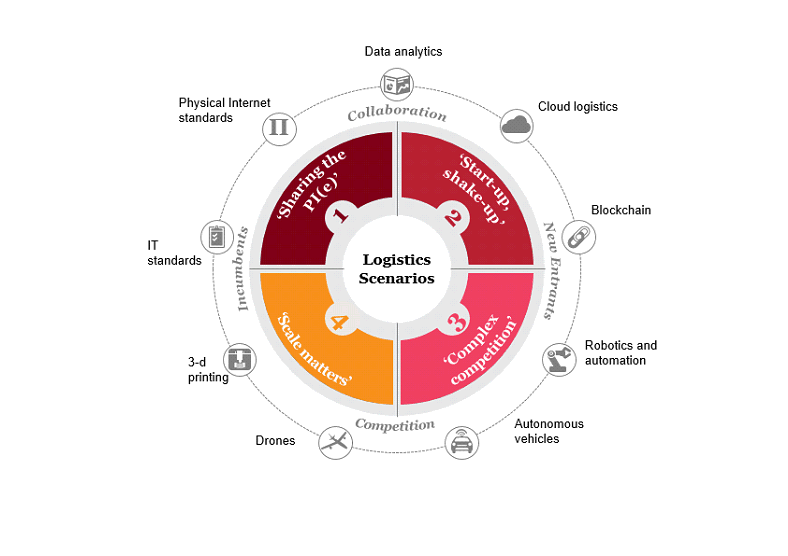

PwC has identified four logistics scenarios exploring possible futures of the industry. In each, technology plays a pivotal role but affects the market differently. In two scenarios, new entrants are the primary driver, while in the remaining two, the incumbents remain dominant.

1. Sharing the PI(e)

Incumbents increase efficiency through collaboration and new business models like sharing networks. Research and collaboration around the Physical Internet (PI) delivers shared standards for shipment sizes and greater modal and IT connectivity across the incumbents.

2. Start-up, shake-up

New entrants capture market share from incumbents by utilising new business models based on disruptive technologies like blockchain and data analytics, with only one or two replicating the technology that has created B2C giants like Amazon. Last-mile deliveries become fragmented, with incumbents collaborating with new entrants and crowd-delivery solutions.

3. Complex competition

The big retailers become new entrants, expanding existing logistics offering beyond their own needs – moving from customers to competitors acquiring small logistic operators to utilise deep B2C knowledge, previous technology suppliers and customer-centricity, to optimise supply chains.

4. Scale matters

Incumbents streamline operations, utilising new technologies and financing technology disrupters with Venture Capital partners and technology – rather than logistics – talent. Major players complete synergistic mergers to enhance geographies and cross-modal coverage.